18+ Va home loan rates

Peter Warden Military VA Loan contributor. After all those with low credit scores generally enjoy the same.

Fthb Realtor Com Economic Research

Learn more about the.

. Va Mortgage Rates Cash Out Refinance - If you are looking for a way to reduce your expenses then our service can help you find a solution. If youre eligible for a VA loan it may be the right option for you. The 30-year fixed mortgage rate on September 5 2022 is up 15.

The 52-week high rate for a VA fixed mortgage rate was 543 and the 52. Va out refinance rates refinance mortgage. For people with poor credit especially the low interest rates offered through the VA home loan program are very enticing.

Heres an overview of todays VA mortgage rates. According to a weekly survey of 100 lenders by Freddie Mac t he average mortgage interest. For today September 9th 2022 the current average mortgage rate for a 30-year fixed-rate mortgage is 5668 the average rate for a 15.

APR Annual Percentage Rate is. APR is the all-in cost of your loan. For today Monday September 12 2022 the national average 30-year VA mortgage APR is 5510 up compared to last weeks.

Though it briefly dipped below 5 in early August the average 30-year fixed mortgage rate is now back up to 589 the highest its been since. 6 More States Stop Taxing Military Retirement Nearly 300000 more military retirees are now exempt from state. Current refinance rates.

Todays VA Loan Rates. A full percentage point. We offer VA home loan programs to help you buy build or improve a home or refinance your current home loanincluding a VA direct loan and 3 VA-backed loans.

On Saturday September 10 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year VA mortgage rate is 5400 with an. The current average 30-year fixed mortgage rate climbed 7 basis points from 570 to 577 on Monday Zillow announced. Rates for a 30-year fixed-rate conventional mortgage are currently at 6 while the interest rate for a 30-year fixed-rate VA loan is slight above 5.

How can you use your VA home loan benefit to build a home. You can use our VA eligibility tool or call a loan officer at 800-531-0341 to discuss your specific. The typical funding fee ranges from 14 to 360 of the loan amount.

Mortgage loan can be refinanced. The annual percentage rate APR on a 30-year fixed-rate mortgage is 565. The average APR on a 15-year fixed-rate mortgage rose 3 basis points to 5227 and the average APR for a 5-year adjustable-rate mortgage ARM fell 5 basis points to.

Find Your Rate Today. Reach your dream with the VA lender trusted by 300000 Veterans. Find average mortgage rates for the 30 year VA fixed mortgage from Mortgage News Daily rate survey.

Todays national VA mortgage rate trends. Todays rate on a 30-year fixed VA loan is 543 compared to the rate a week before of 516. 30-Year Fixed VA Purchase Loan.

The APR was 547 last week. Rates listed are for primary residence in single family home with a 0 down payment and borrower credit score of 740. 1 day agoSep 12 2022 300 AM.

You will need a COE. If your credit score is below 600 you might have some hard time getting it but it certainly isnt impossible. With todays interest rate of.

A typical VA home loan requires a minimum credit score of 600 to 630. In many cases youll have the option to roll the VA funding fee into your loan. The APR shown of 5335 is available for a 30-year VA fixed rate loan in the amount of 200000 for consumers with loan-to-value of at least 80.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23659458/6_29_22_pallante_baseball_savant_pitching_illustrations.jpg)

Live Mlb Coverage Marlins Vs Cardinals News Matchups Highlights Fish Stripes

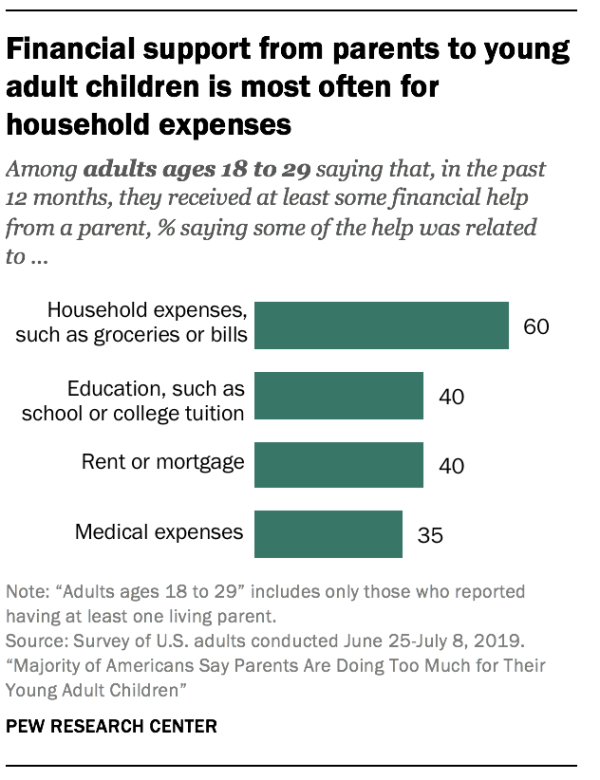

Only 24 Of Young Adults Are Financially Independent By 22 Per Pew

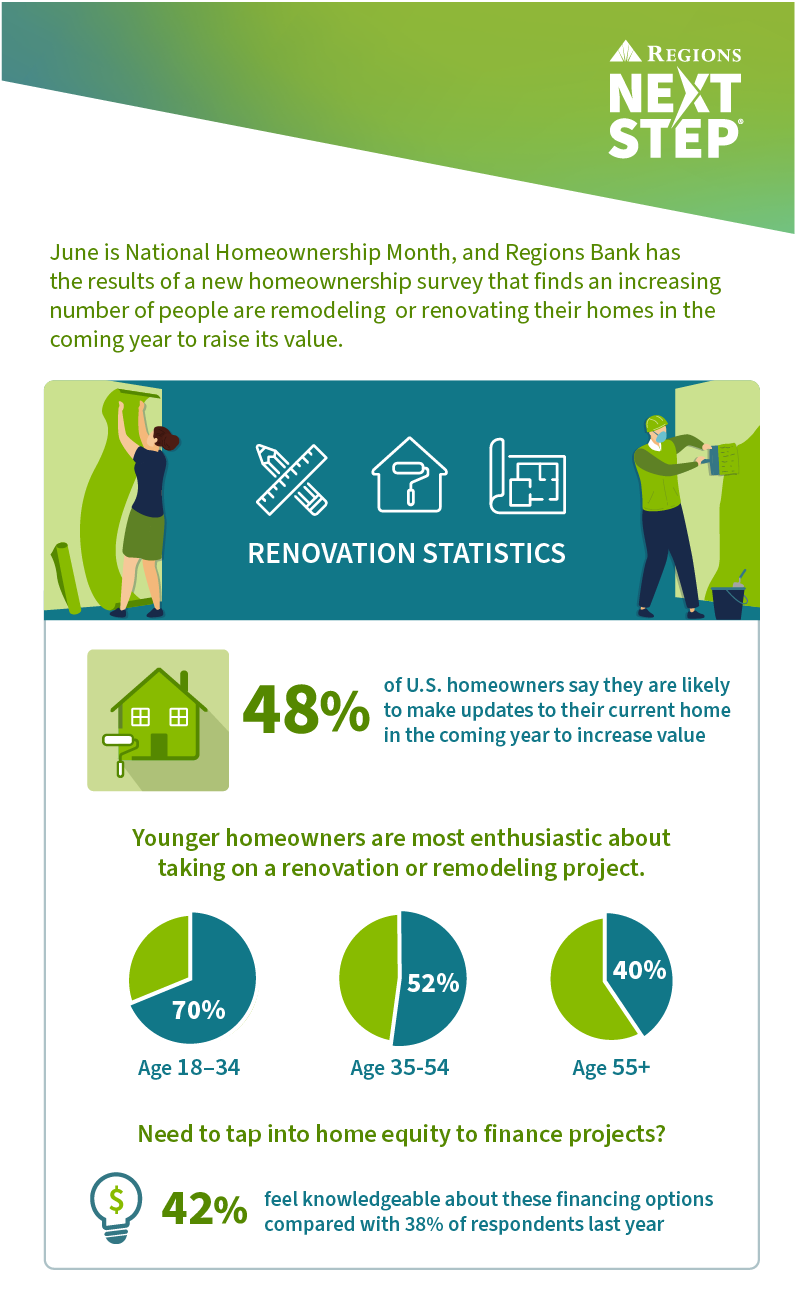

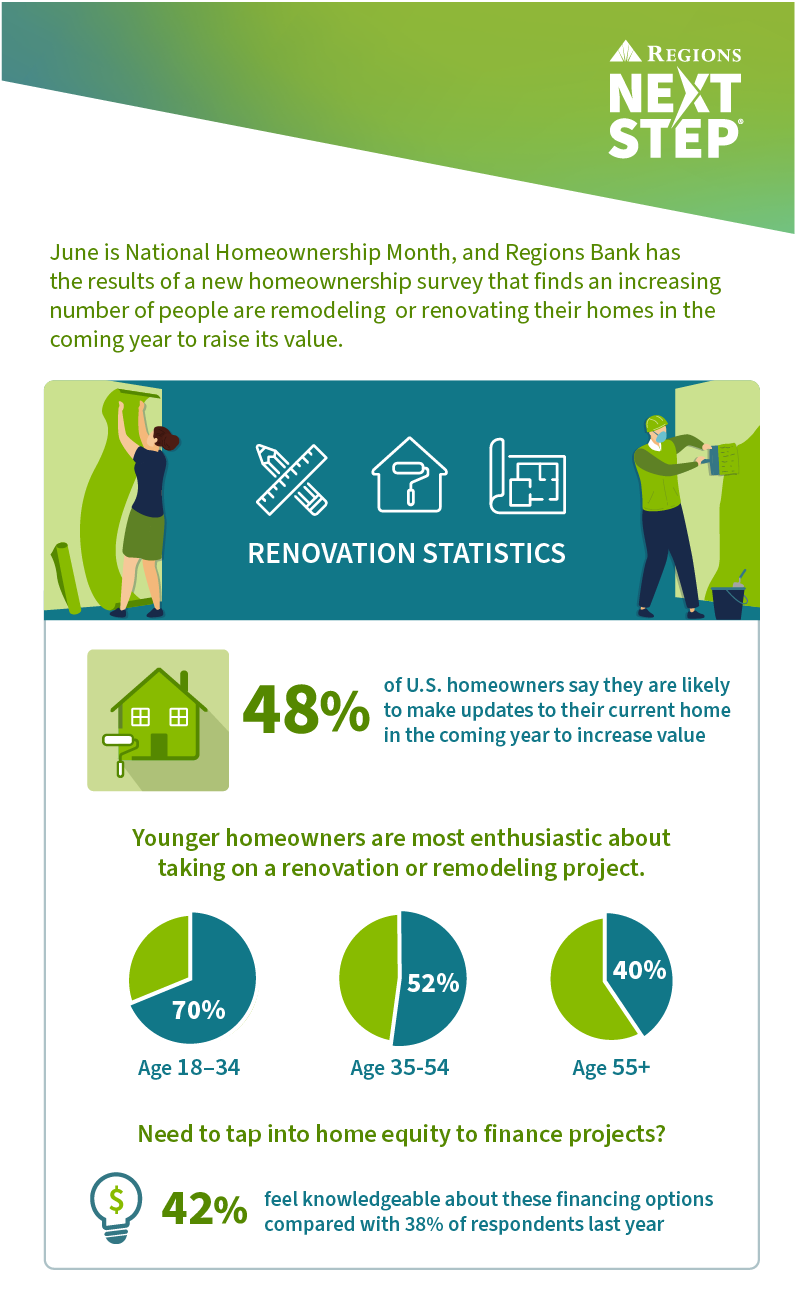

Csrwire Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value

2

Kenita Tang Property Group Home Facebook

Generational Insights Realtor Com Economic Research

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23467827/5_14_22_rogers_baseball_savant_pitching_illustrations.jpg)

Mlb Game Preview Fan Chat Marlins Vs Brewers May 14 2022 Fish Stripes

Appraisals Check The Water Source Appraisal Today

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

New Times Nov 18 2021 By New Times San Luis Obispo Issuu

Generational Insights Realtor Com Economic Research

/cdn.vox-cdn.com/uploads/chorus_asset/file/23584022/MIA5.png)

Rays Vs Marlins Preview What S New In The Citrus Series For 2022 Fish Stripes

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23935826/Broja.png)

Scouting All The Strikers Everton Have Been Linked With Broja Adams Gyokeres Guirassy Kalajdzic Ajorque Moffi Royal Blue Mersey

Fthb Realtor Com Economic Research

Why The New Inflation Report Is Sending Stocks Higher

Fthb Realtor Com Economic Research

Csrwire Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value